Yes, accounts receivable turnover can be used as one of the metrics to assess a company’s creditworthiness. A higher turnover ratio suggests better credit management and a lower risk of default, while a declining ratio may raise concerns about the company’s ability to collect payments in a timely manner. Use this accounts receivable turnover calculator to quickly determine how many times your company collects its average accounts receivable in a year. Lastly, many business owners use only the first and last month of the year to determine their receivables turnover ratio. However, the time it takes to receive payments often varies from quarter to quarter, especially for seasonal companies.

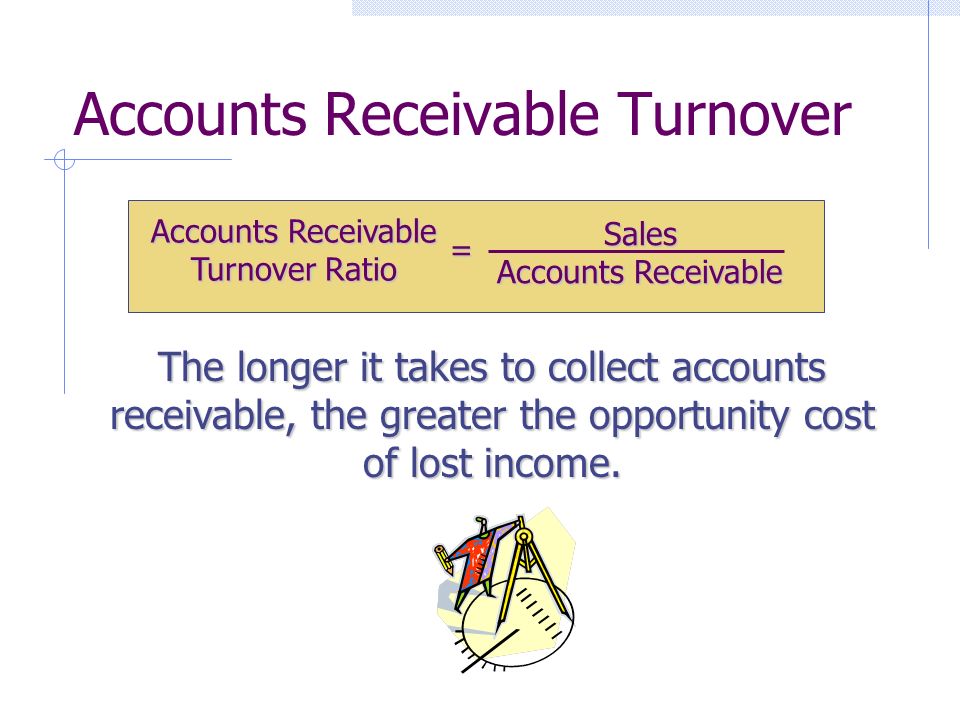

How to Calculate Accounts Receivable Turnover Ratio

First, you’ll need to find your net credit sales or all the sales customers made on credit. Furthermore, because this ratio considers the average performance across your entire customer base, it lacks the precision needed to pinpoint specific accounts at risk of default. For a deeper understanding at this level, it is advisable to generate an accounts receivable aging report. In this example, the company has a low result indicating improvements to the company’s credit management processes are required.

Finance Calculators

The faster you catch a missed payment, the faster (and more likely) your customer can pay. If your accounts receivable turnover ratio is lower than you’d like, there are a few steps you can take to raise the score right away. A low ratio may also indicate that your business has subpar collection processes.

The purpose of A/R Turnover Ratio: Why should we calculate A/R Turnover Ratio?

If clients have mentioned struggling with or disliking your payment system, it may be time to add another payment option. Credit policies that are too liberal frequently bring in too many businesses that are unstable and lack creditworthiness. If you never know if or when you’re going to get paid for your work, it can create serious cash flow problems. Cleaning companies, on the other hand, typically require customer payment within two weeks.

Receivables Turnover Ratio Calculator

- Once you have calculated your company’s accounts receivable turnover ratio, it’s nearly time to use it to improve your business.

- This investment comparison approach is not recommended for the comparison of companies operating in different industries.

- You may simply end up with a high ratio because the small percentage of your customers you extend credit to are good at paying on time.

The first part of the accounts receivable turnover ratio formula calls for your net credit sales, or in other words, all of your sales for the year that were made on credit (as opposed to cash). This figure should include your total credit sales, minus any returns or allowances. You should be able to find your net credit sales number on your annual income statement or on your balance sheet (as shown below).

Your accounts receivable turnover ratio measures your company’s ability to issue credit to customers and collect funds on time. Tracking this ratio can help you determine if you need to improve your credit policies or collection procedures. Additionally, when you know how quickly, on average, customers pay their debts, you can more accurately predict cash flow trends. And if you apply for a small business loan, your lender may ask to see your accounts receivable turnover ratio to determine if you qualify. The accounts receivables turnover ratio measures the number of times a company collects its average accounts receivable balance.

Regardless of the why Investors must remain vigilant and understand how a ratio is calculated before making decisions on whether to invest or not. We’ll do a calculation using a fictional company’s financial records net fixed assets formula for a period of January 1 to December 31. As we previously noted, average accounts receivable is equal to the first plus the last month (or quarter) of the time period you’re focused on, divided by 2.

The receivable turnover ratio is used to measure the financial performance and efficiency of accounts receivables management. This metric helps companies assess their credit policy as well as its process for collecting debts from customers. The receivable turnover ratio, otherwise known as debtor’s turnover ratio, is a measure of how quickly a company collects its outstanding accounts receivables. The ratio shows how many times during the period, sales were collected by a business. The receivable turnover ratio, otherwise known as the debtor’s turnover ratio, is a measure of how quickly a company collects its outstanding accounts receivables. The accounts receivable turnover ratio, also known as receivables turnover, is a simple formula that calculates how quickly your customers or clients pay you the money they owe.