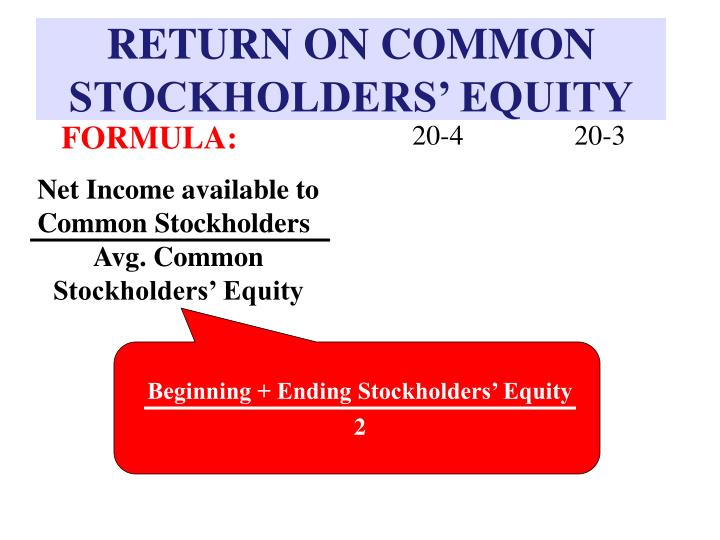

Many investors also choose to calculate the return on equity at the beginning of a period and the end of a period to see the change in return. This helps track a company’s progress and ability to maintain a positive earnings trend. Also, average common stockholder’s equity is usually used, so an average of beginning and ending equity is calculated. In conclusion, ROCE isolates common equity for profitability evaluation but isn’t foolproof due to potential information gaps. A good use case is comparing a company’s ROE over time to understand whether it’s doing a better or worse job delivering profits now than in the past. If the firm’s ROE is steadily increasing in a sustainable manner—increases are not sudden or really huge—you might conclude that management is doing a good job.

- The ratio measures the returns achieved by a company in relation to the amount of capital invested.

- Industries with relatively few players and where only limited assets are needed to generate revenues may show a higher average ROE.

- In addition, larger companies with greater efficiency may not be comparable to younger firms.

- If shareholders’ equity is negative, the most common issue is excessive debt or inconsistent profitability.

- The next step involves computing the Average Shareholders’ Equity over a given period—achieved by averaging the beginning and ending equity figures, as found on the company’s balance sheet.

Return on Equity (ROE)

It’s difficult to compare ROE across industries, although comparing a given company’s ROE to the average in its industry shows you how well a company does at generating profits compared to its peers. The ratio measures the returns achieved by a company in relation to the amount of capital invested. The higher the ROE, the better is the firm’s performance has been in comparison to its peers.

Return on Equity Calculation Example (ROE)

Instead, the better benchmark is to compare a company’s return on common equity with its industry average. ROCE is a financial metric that calculates the return generated by a company on its common equity, which is the shareholders’ equity less preferred dividends. It shows the percentage of profits earned from each dollar of equity investment by the shareholders.

How to Calculate Return on Equity (ROE)

Higher ratios are almost always better than lower ratios, but have to be compared to other companies’ ratios in the industry. Since every industry has different levels of investors and income, ROE can’t be used to compare companies outside of their industries very effectively. Due to variations in average ROCE ratios across industries, it is less suitable for cross-sector comparisons. Furthermore, ROCE serves as a tool for evaluating a company’s performance over time, shedding light on whether its financial health is on an upward trajectory or in decline. Even a company with a strong financial history but a deteriorating trend may not be an attractive investment. Return on equity (ROE) is a financial ratio that tells you how much profit a public company earns in comparison to the net assets it holds.

It also tells common stock investors how effectively their capital is being reinvested. Generally, a company with high return on equity (ROE) is more successful in generating cash internally. Investors are always looking for companies with high and growing returns on common equity; however, not all high ROE companies make good investments.

ROE looks at how well a company uses shareholders’ equity while ROIC is meant to determine how well a company uses all its available capital to make money. An extremely high ROE can be a good thing if net income is extremely large compared to equity because a company’s performance is so strong. Average shareholders’ equity is calculated by adding equity at the beginning of the period.

For instance, companies operating in a booming industry may experience higher returns due to increased demand, while those in a declining industry may struggle to generate profits. To achieve this, companies can either retain their earnings or issue new shares to raise additional capital. Finally, about the stock market, you will notice that a high ROE will increase the stock price. However, you can even protect your returns by only investing in a stock that’s above its 7-day moving average price.

Interpreting ROCE requires understanding the results in the context of the company’s operations and industry benchmarks. A high ROCE indicates that the company is generating substantial returns on its equity investment, while a low mortgage payment relief during covid ROCE may signify inefficiency or suboptimal performance. Prudent investors take other factors into consideration before buying into a company such as earnings per share, return on invested capital, and return on total assets.

An investor could conclude that TechCo’s management is above average at using the company’s assets to create profits. Return on equity is considered a gauge of a corporation’s profitability and how efficiently it generates those profits. The higher the ROE, the more efficient a company’s management is at generating income and growth from its equity financing.

In this section, we will compare ROCE to other financial metrics to uncover its strengths and limitations. This comparison underscores how different metrics can complement one another to enhance the accuracy of profitability assessments. All these situations highlight the importance of not solely relying on ROCE and reported profits to gauge a company’s financial health. Dividends are influenced by factors beyond profitability, emphasizing the need for a more comprehensive assessment. Ex’s ROCE of 16% indicates that for every dollar invested, a return of 16% can be expected from the company’s net income. If the industry average stands at 20%, Henry might reconsider his investment in Ex in search of better opportunities.

In any case, a company with a negative ROE cannot be evaluated against other stocks with positive ROE ratios. Net income is calculated as the difference between net revenue and all expenses including interest and taxes. It is the most conservative measurement for a company to analyze as it deducts more expenses than other profitability measurements such as gross income or operating income. These financial ratios form the basis of fundamental research, which is key to finding high-quality dividend stocks that could be the backbone of your retirement. Editors at Investors Alley do that work all day long, and you can see their findings by subscribing to Investors Alley’s Dividend Hunter newsletter.